Accept Online Payments in NZFast, Secure, and Built for Kiwi Businesses

New Zealand’s first payment gateway purpose-built on the open banking standard. BlinkPay offers account-to-account payments, near real-time settlements and lower transaction fees - so you’ll get paid faster and pay less.

Trusted by NZ Businesses Adopting Open Banking

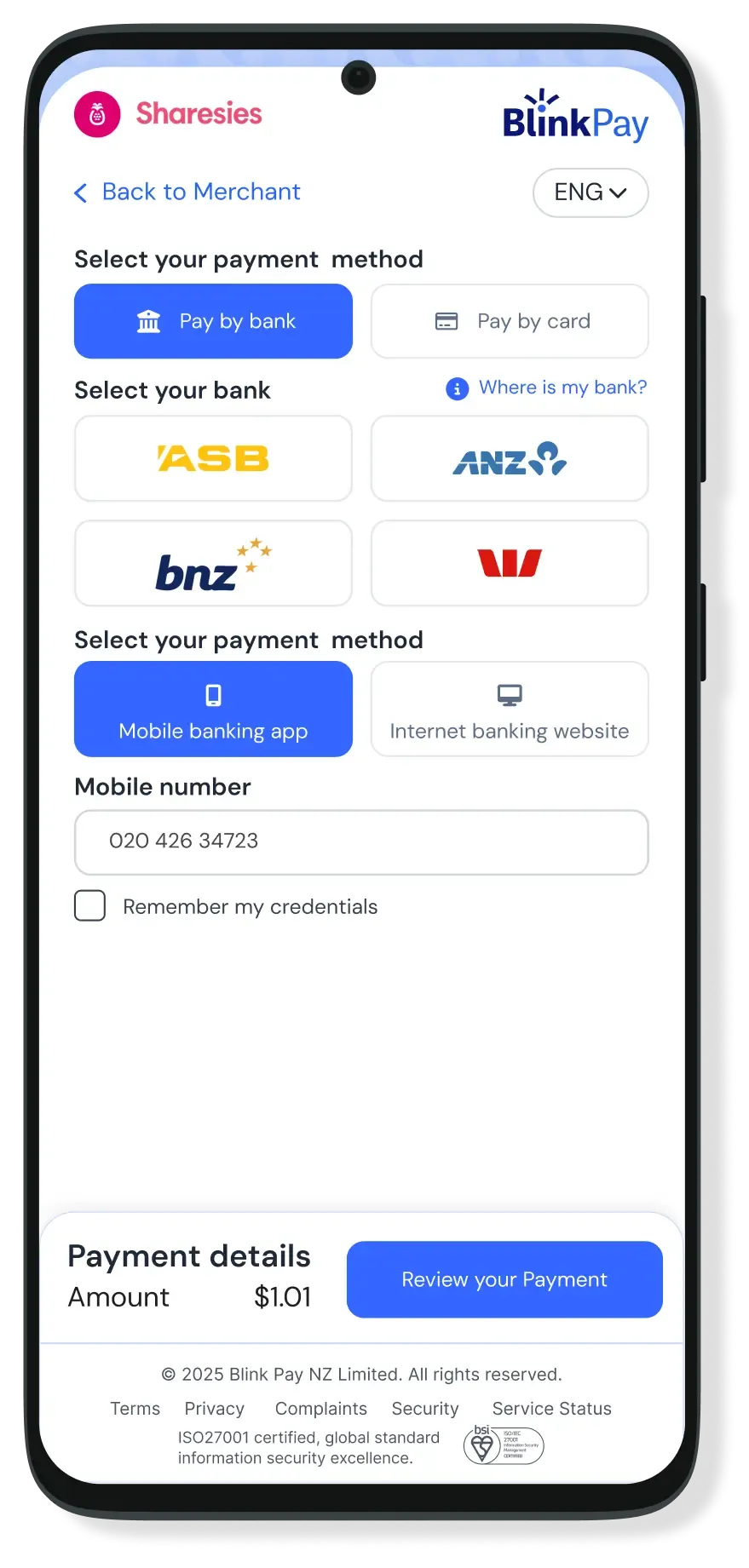

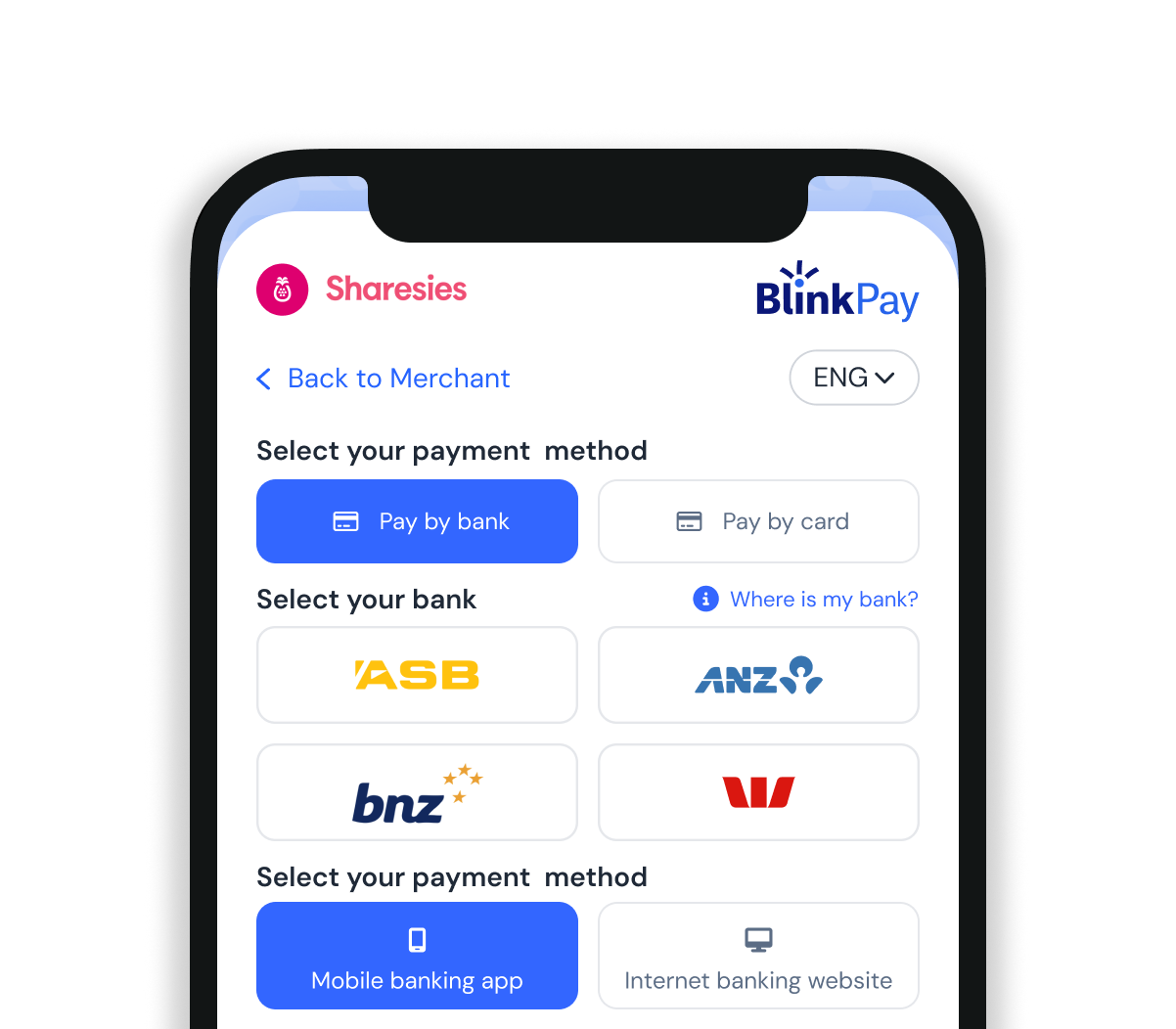

Join the growing number of forward-thinking Kiwi companies — including recognised brands like Sharesies — that are transforming their payment experience with BlinkPay’s open banking gateway. With lower fees and near real-time settlement, BlinkPay helps local businesses move faster.

Sharesies

Sharesies customers are incredibly cost and time sensitive.

"Enabling our customers to fund their Wallet at speed and at reduced cost is a priority for us. The BlinkPay team has been the perfect partner in unlocking Instant bank transfers for Sharesies customers, their security first attitudes, future focused tech stack, and willingness to muck in with the Sharesies team, made for a painless integration and the start of fruitful and long partnership."

sophia.wong@blinkpay.co.nz

Product Lead Mobile and Marketing

Sharesies Business Impact

Instant

Real-time wallet funding vs. 1-3 day traditional bank transfers

97%

Growth in average deposit amount per transaction

15%

Revenue increase per investor following integration

67%

Savings Cost reduction compared to card processing fees

Get more insights with the Sharesies Case Study

Why Choose BlinkPay For Accepting Payments Online?

Lower fees, faster settlement, enterprise-grade security, and local New Zealand support — BlinkPay is the modern way for businesses to accept online payments.

Faster Settlements

Most payments settle within 2 hours

Lower Fees

Up to 70% savings compared to credit card fees.

Secure by Design

ISO/IEC 27001:2022 certified and no screen scraping.

Local Support from Payment Experts

Our Aotearoa-based team offers support from specialists who really understand payments.

Faster Settlements

Most payments settle within 2 hours

Lower Fees

Up to 70% savings compared to credit card fees.

Secure by Design

ISO/IEC 27001:2022 certified and no screen scraping.

Local Support from Payment Experts

Our Aotearoa-based team offers support from specialists who really understand payments.

Streamline Your Payment Operations With BlinkPay

BlinkPay helps Kiwi businesses accept bank payments online through open banking — with lower fees, near real-time settlement, and fast onboarding. Join others improving their cashflow and reducing overhead today.

67%

Average savings on transaction fees compared to traditional card processors like Stripe

2hrs

Typical maximum settlement time for approved payments

Supported

Access to NZ-based open banking support specialists

Easy

Average setup time to create your BlinkPay merchant ID

Transparent Pricing

No hidden fees, no surprises – just honest pricing for Kiwi businesses

Trusted By Leading New Zealand Businesses

From fintech innovators to major banks, forward-thinking Kiwi organisations use BlinkPay’s open banking gateway to deliver secure and efficient account-to-account payments.

"Whale Watch Kaikoura Ltd has now been using Blinkpay as a payment option for our customers for over 2 years, and find this to be the best payment option we have."

Angela C.

Finance & Administration Manager

Whale Watch,

Kaikoura NZ

"BlinkPay's security ethos was a major factor in our partnership. We prioritize protecting our investors' data, and BlinkPay's approach of not handling or retaining payments data gives our investors peace of mind when making instant transfers."

Brooke R.

Co-CEO

Sharesies,

Wellington

"BlinkPay is redefining the way payments are made in Aotearoa New Zealand, delivering a seamless and efficient solution that benefits both businesses and consumers."

Jonathon D.

Head of Payment Development

BNZ,

Auckland

Developer-First Open Banking API for New Zealand

BlinkPay’s RESTful API makes it simple for developers to integrate secure bank payments into websites, mobile apps, or existing checkouts. With real-time webhooks, sandbox testing, and full API documentation, you can start accepting payments with ease.

Simple Integration

Get started quickly using our SDKs or RESTful API — designed for smooth integration into websites, apps, and backend systems.

Comprehensive API Documentation

Access detailed guides, code samples, and OpenAPI specifications to get building fast.

Direct Developer Support

Work directly with our technical team to resolve issues and optimise your implementation.

POST https://debit.blinkpay.co.nz/payments/v1/payments

Authorization: Bearer ACCESS_TOKEN

{

"consent_id": "035d4ea4-4037-4110-9861-183eae1408b4",

"pcr": {

"particulars": "INV123",

"code": "PAYMENT",

"reference": "CUST456"

},

"amount": {

"total": "100.00",

"currency": "NZD"

}

}Bank-Grade Security & Open Banking Compliance

Your business and customers deserve the highest level of data protection. BlinkPay’s platform is certified, independently tested, and designed to meet the strict security requirements of New Zealand’s major banks.

Bank-Approved Security

Our platform meets the formal security and integration standards of NZ’s largest banks. We undergo regular penetration testing and independent security audits.

ISO/IEC 27001:2020 Certified

BlinkPay is ISO/IEC 27001:2022 certified, demonstrating our commitment to the secure handling and governance of sensitive financial information.

No Screen Scraping

We never screen scrape. Your customers’ credentials remain secure and are exchanged only between them and their bank, via official APIs.

Open Banking Q&A with BlinkPay

Listen to our latest discussions about open banking and payment innovation in New Zealand. Discover insights from industry experts and learn how BlinkPay is transforming the payment landscape.

The State of Open Banking in NZ — 2025 and Beyond

Join our conversation about New Zealand's open banking ecosystem and how it's reshaping digital payments for businesses and consumers.

About this episode

This podcast is dedicated to all the payments and data enthusiasts in Aotearoa 😊

This week we're diving into the recent news about API fees, the open banking regulations under the Customer and Product Data Act and the newly announced 'instant payments' service from BlinkPay.

What We Cover

API fees

Latest developments and implications for businesses navigating the evolving cost structure

Open banking regulations

Understanding the Customer and Product Data Act and its impact on the financial sector

Instant Payments

New real-time payments capability using open banking infrastructure

Enduring consent

Features, benefits, and key differences from traditional Direct Debits

Who's On the Mic

Adrian Smith

CEO, BlinkPay

Tim D'Shea

Head of Product, BlinkPay

Dan Symons

Senior Manager, Consulting & Insights, Westpac NZ

Lisa Ibarra

Head of Innovation, Payments NZ

Start Accepting Bank Payments With BlinkPay

- Join New Zealand businesses using BlinkPay’s open banking gateway to offer faster, more secure, and lower

- cost payments — with full NZ bank integration and near real

- time settlement.